Though the remote town of Hāna is best known for being nestled along the famously scenic Hāna Highway—one of the most beautiful drives in the world—few may be aware that many of its native residents are medically underserved due to financial, cultural, and geographical barriers. As the only primary health care provider in the Hāna District in Maui County, HI, Hāna Community Health Center Inc., (Hāna Health) provides much needed health care services to its isolated Hawaiian community, of which 88% of residents live at or below 200% of the Federal Poverty Level.

Capital Fund recently provided $2 million in financing to support Hāna Health’s nearly $6 million clinic expansion to provide new services such as physical therapy, behavioral health, and telemedicine, which will help the center better meet patient needs. In addition to Capital Fund’s loan, financing included equity from the following sources: a HRSA Health Infrastructure Investment Program Grant, The Harry and Jeanette Weinberg Foundation, a 2019 state grant, Hāna Health reserves, The McInerny Foundation, and Hāna community donations.

The new clinic will include space for behavioral and mental health services, physical therapy, complementary and traditional healing medicine, cardiac rehabilitation, and healthy lifestyle and physical fitness programs for the prevention and management of chronic health conditions. The new facility will enable Hāna Health to hire eight new staff members, which will be a combination of direct employees and contract staff. Construction is slated to be completed at the end of 2022.

In 2020, Hāna Health provided services to 1,664 patients through 5,876 visits with 20 FTEs. The additional services provided in the new space will allow the center to increase patients by 36% (2,258 total) and visits by 79% (10,500 total). Approximately half of its patients are Native Hawaiians, 38% are White, and 12% are other races. Learn more about Hāna Health here >

To learn more about Capital Fund’s loan products, including our new LoanPlus program, please contact Brandon Boyle, Director of Loan Programs, at This email address is being protected from spambots. You need JavaScript enabled to view it..

Capital Fund and Capital Link are excited to announce Rebecca (Becky) Regan as its new Chief Executive Officer, following the retirement of longtime CEO, Allison Coleman, after nearly 30 years leading both organizations. Ms. Coleman will stay on as CEO over the summer to assist Regan's transition into her new role, and Regan will take the helm officially on September 1, 2022.

“What inspires me most about Becky is her drive, her creativity and curiosity and her commitment to improving the lives of low-income community residents,” Coleman said. “She is mission-driven at her core and has a deep interest in healthcare, FQHCs, and the ways they can partner with others to address the social determinants of health,” added James W. Hunt, Jr., Board Chair of both organizations.

Regan brings 25 years of experience working in community development to drive social sector change, coming from a background in management, strategy, leadership, finance and capital raising. In addition to driving innovations in health and housing within a network of 100 non-profit housing organizations and CDFIs across the U.S. in her previous roles, she also has served on the Capital Fund Board of Directors since 2014.

"I am honored to have been chosen to lead Capital Link and Capital Fund at a time in which the need for the growth and development of community health centers has never been greater. The two organizations uniquely combine the intellectual capabilities, data and insights from consulting work and access to capital resources. This combination creates rare opportunities for catalytic impact in the high-need communities health centers serve. I am excited to bring my energy and passion to both organizations, building on a strong foundation to inspire a new vision for the future,” she said of her drive for elevating Capital Link's mission.

Regan's previous work experience includes nearly 10 years as Executive Vice President of the Housing Partnership Network in Boston, as well as serving as the President of the Loan Fund at BlueHub Capital (formerly Boston Community Loan Fund) in Boston, where she was responsible for setting strategy, hiring and managing a team of lenders and raising capital for lending.

Over her expansive career focused on community development, she has raised over $400M in debt, equity, and grants for non-profit housing developers, CDFIs and social enterprises. As an executive leader she helped drive the creation of a $35M fund raised to purchase defaulted mortgages in low-income areas and work with homeowners to renegotiate their mortgage terms to allow them to stay in their homes at affordable monthly payments.

Regan was brought on as CEO following a national search by Koya Partners, an executive search firm that specializes in leading mission-driven searches at the senior level.

Capital Fund recently provided financing for Neighborhood Health Centers of the Lehigh Valley (NHCLV)'s $3.87 million capital expansion in Allentown and Bethlehem, PA. NHCLV utilized Capital Fund's new LoanPLUS loan program, designed to meet the needs of smaller health centers and/or those with limited financial resources.

Financing for this project included a loan of $1,168,750 from Capital Fund, a loan of $956,250 from Community First Fund, and an NHCLV cash equity contribution of $1.46 million with an additional $601,074 in federal grant investments, including an American Rescue Plan Capital Projects Fund award. The loans are secured in part by a federal Loan Guarantee from the Health Resources and Services Administration.

For its Allentown renovation, NHCLV will renovate and expand the first floor of an existing 14,200-square-foot retail space into a similarly sized health center site. The construction will add 18 clinical and support rooms designed to facilitate team based care and health professionals’ education, triage/walk-in care, procedural rooms as well as a small dental pod and on-site pharmacy for the health center’s patients. The space will also include an education room and administrative support space.

The Bethlehem project will expand an existing site by 3,800 square feet in order to offer a full range of dental services, including preventative care, basic restorative including fillings, extractions, dentures, crowns and basic bridges as well as also adding an on-site pharmacy for the health center’s patients.

For more details about these NHCLV capital projects, click here.

Neighborhood Health Centers of the Lehigh Valley (NHCLV), the HRSA federally qualified Health Center Program Awardee in the area, operates four locations in Allentown, Bethlehem, and Easton, PA. Awarded this 330 Program designation in 2012, NHCLV serves the area’s low-income population. NHCLV offers a wide range of medical care including general well/sick care, pediatrics, behavioral health, and substance use disorder services. According to recent data of NHCLV's patients who reported their incomes, 67% were at 100% below the federal poverty line, 28% were between 101-200%, and 5% were over 200% below. Two-thirds of the health center’s patients are minorities, with 65% identifying as Latino/Hispanic and 78% preferring to receive care in a language other than English. Learn more about NHCLV here >

To learn more about Capital Fund’s loan products, including our new LoanPlus program, please contact Brandon Boyle, Director of Loan Programs, at This email address is being protected from spambots. You need JavaScript enabled to view it..

Has your health center had trouble accessing financing through commercial banks? Capital Fund’s new LoanPLUS loan program, designed to meet the needs of smaller health centers and/or those with limited financial resources, might be able to help.

The LoanPlus program provides loans with flexible collateral and repayment terms to meet the financing needs of FQHCs. Loans can range in size from $400,000 to $2,000,000 and can be used for cashflow, renovations, construction, refinancing of existing debt and/or the purchase of property. LoanPlus clients will also receive free annual technical assistance tailored to meet their needs.

As a LoanPLUS borrower, your organization will be eligible to receive one of the following reports from our affiliate Capital Link each year that your loan is outstanding:

Market Snapshot

Performance Evaluation Profile

Value and Impact Report

In addition, you will also receive up to five hours of free consultation from Capital Link. LoanPLUS can be used in conjunction with NMTC financing and HRSA capital grants, particularly the American Rescue Plan - Health Center Construction and Capital Improvements (C8E) grants.

For questions about LoanPLUS, please contact Brandon Boyle, Director of Loan Programs, at This email address is being protected from spambots. You need JavaScript enabled to view it. or by phone at 617-988-2265.

Community Health Center Capital Fund was recently awarded a $2 million program-related investment loan and a $150,000 grant from Opportunity Finance Network’s Finance Justice Fund to support its direct loan program. The award will enable Capital Fund to increase its capacity to offer affordable loans to Federally Qualified Health Centers (FQHCs) across the US for construction, renovation, and expansion of health center facilities and related equipment. As a key component of the primary care safety net in the United States, in 2020, FQHCs served almost 30 million patients annually, 58% of whom were racial and/or ethnic minorities, 30% of whom lived in rural communities and 91% of whom had low-incomes.

“Congratulations to Community Health Center Capital Fund for its Finance Justice Fund award. This capital will help address long-standing issues of disinvestment, the racial wealth gap, and persistent poverty in our country,” said Opportunity Finance Network (OFN) President and CEO Lisa Mensah. “CDFIs, like Capital Fund, and Finance Justice Fund partners and investors are helping to advance social, economic, and racial justice one loan at a time.”

Launched by OFN in 2020, the Finance Justice Fund is a new socially responsible investment that aims to bring $1 billion in capital from corporate and philanthropic partners to individuals and communities in America most underestimated and underserved by mainstream finance. Twitter was the Fund's first investor, followed this summer by Wells Fargo. The goal of the Finance Justice Fund is to drive affordable, responsible capital to Black, Latinx, Indigenous, and rural communities. To learn more about the Finance Justice Fund and view a full list of Fund partners and awardees, please visit OFN.org.

For more information about Capital Fund’s program related investment opportunities or FQHC loan products, please contact Brandon Boyle, Director of Loan Programs, at This email address is being protected from spambots. You need JavaScript enabled to view it. or by phone at 617-988-2265.

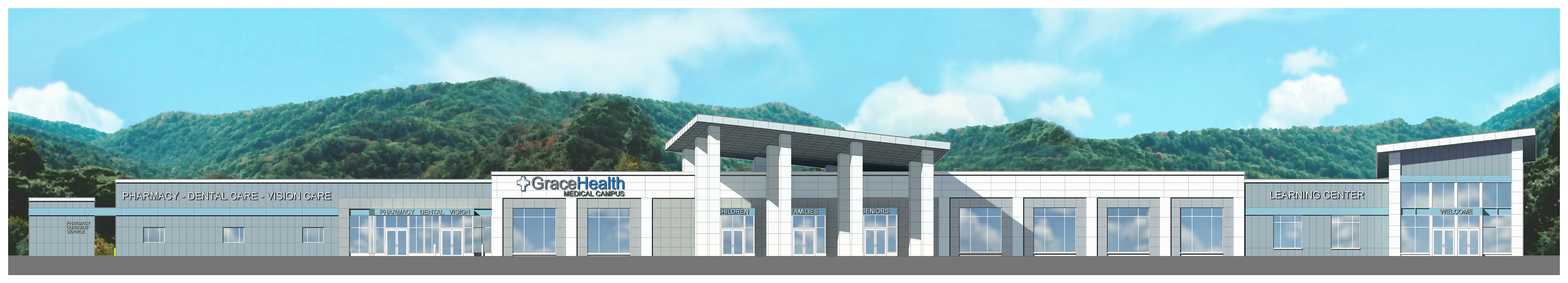

On July 2, 2021, Capital Fund closed financing for a $26.3 million renovation and relocation project for Grace Community Health Center, dba Grace Health, in Corbin, KY.

In addition to Capital Fund's $12.2 million New Markets Tax Credit (NMTC) allocation and $2 million source loan, funding for this project also included contributions from Primary Care Development Corporation, Local Initiatives Support Corporation (LISC), Forcht Bank, and Capital One. The project also utilized the HRSA Loan Guarantee Program (LGP) to provide additional security for the transaction.

Capital Fund's affiliate, Capital Link, provided NMTC advisory services to Grace Health and successfully attracted $20.2M of NMTC subsidization for Grace’s medical campus project, as well as the HRSA LGP.

Grace Health plans to renovate and transform an existing 88,000-square-foot building into a state-of-the-art medical campus. This project will allow Grace Health to better respond to unmet medical, dental, mental health and substance abuse treatment needs in Knox and Whitley Counties through consolidating four smaller satellite sites into the proposed larger facility. The resulting medical campus, which will have 32 exam rooms, will allow the health center to serve an additional 14,000 patients annually. Pre-construction began in November 2019 and construction is expected to finish in 2022. In total, Grace Health anticipates adding between five and seven providers and 15 support staff.

The expansion project is situated in a severely distressed rural neighborhood in Kentucky and the project's census tract/NMTC eligibility shows the poverty rate of this service area is at 29% and the unemployment rate is 1.35 times the national average. The region has suffered severe economic hardship as coal mining, once a significant industry, has decreased due to a national shift away from coal and toward other energy sources.

Grace Health is a Federally Qualified Health Center (FQHC) serving the southeastern Kentucky counties of Bell, Clay, Knox, Laurel, Leslie, and Northern Whitley. The health center currently has nine satellite clinics consisting of seven primary care clinics, a women's care facility, and a pediatric clinic. In addition, Grace Health operates 32 school-based health centers. Learn more here >

To learn more about Capital Fund’s loan products, including New Markets Tax Credits, please contact Brandon Boyle, Director of Loan Programs, at This email address is being protected from spambots. You need JavaScript enabled to view it..

On June 15, 2021, Capital Fund received a $1.8 million award from the United States Treasury's CDFI Rapid Response Program (CDFI RRP). These funds, as part of $1.25 billion in total allocated to 863 community development financial institutions (CDFIs) nationwide, will provide necessary capital for Capital Fund to respond to economic challenges created by the COVID-19 pandemic, particularly in underserved communities. This award will be used to provide loans for health center capital projects and operational needs, in support of their ongoing response and recovery from the pandemic.

The CDFI Fund designed the program to disburse the funds rapidly in light of the nationwide economic impacts of the COVID-19 pandemic. CDFI RRP awards will reach a wide variety of low-income communities across the United States impacted by the COVID-19 pandemic. The awardees include CDFIs that serve rural, major urban, and minor urban markets. A CDFI can be a bank, credit union, loan fund, or venture capital fund. Learn more here >

For questions, please contact Brandon Boyle, Director of Loan Programs, via email at This email address is being protected from spambots. You need JavaScript enabled to view it..

On June 24, 2021, Capital Fund provided financing for The Providence Community Health Centers, Inc., (PCHC) to support its nearly $14 million expansion project.

Capital Fund contributed a $7.5 million New Markets Tax Credit (NMTC) allocation and a $2 million source loan for PCHC’s new 27,000-square-foot facility at 31 Atwood Street in Providence, RI. In addition to financing provided by Capital Fund, project financing also included a NMTC allocation and source loan from Primary Care Development Corporation (PCDC), and $3.8 million equity investment from PCHC.

The proposed project, situated in a severely distressed neighborhood of Providence, will transform a vacant lot into a comprehensive health care center with services including OB/GYN, pediatrics, adult medicine, family medicine, behavioral health, specialty care, urgent care (i.e. express center) and lab. The first floor of the new facility will offer a conference room, waiting room, nurse’s station, break room, storage rooms, x-ray rooms, a blood lab room and 12 exam rooms. The second floor will offer 27 exam rooms, a waiting area/lobby and three nurse’s stations. The project is expected to provide space for and support up to 600 full-time employees (FTEs) in the community and serve up to 86,000 patients by 2028, compared to 474 FTEs and 61,000 patients in 2019. The project is also expected to increase patient visits by 42%, growing from 255,000 in 2019 to an estimated 362,000 in 2028.

PCHC is the largest primary health care provider in Providence and the only Federally Qualified Health Center (FQHC) in the immediate area of the project site. In addition to its 13 current health center sites, PCHC also operates a school-based program and a dental clinic serving children under the age of 19 and pregnant women. PCHC provides comprehensive and culturally sensitive primary health care services to more than 50,000 residents of Providence and its surrounding areas. More than 92% of patients are racial and/or ethnic minorities. Of the patients who reported their income, 98% are at or below 200% of the Federal Poverty Level. Learn more here.

To learn more about Capital Fund’s loan products, including New Markets Tax Credits, please contact Brandon Boyle, Director of Loan Programs, at This email address is being protected from spambots. You need JavaScript enabled to view it..

On January 15, 2021, Capital Fund participated in a financial closing for CommuniHealth Services, to support its $13.1 million expansion project.

Capital Fund contributed a $6.5 million New Markets Tax Credit (NMTC) allocation for CommuniHealth’s new facility. In addition to Capital Fund’s allocation, project financing also included $5.5 million NMTC allocation from Primary Care Development Corporation (PCDC), $5 million in State of Louisiana tax credits, and a PCDC $5 million source loan, of which Capital Fund bought $2 million.

Additionally, Capital Link provided operational facility planning and NMTC technical services to assist CommuniHealth in aligning service delivery objectives with design, preparing financial projections as well as a business plan, and NMTC intake and community impact information, which Capital Link successfully presented to and attracted interest from Federal and State CDE/CDFI Allocatees, source loan providers and two different equity investors (Federal and State). Capital Link assisted MCMC in its collaboration with multiple transaction parties throughout the closing process to successfully deliver all of the many deliverables required to close and fund a NMTC leveraged transaction.

The new 41,260-square-foot facility—a 27,500-square-foot increase from its current clinics—will consolidate its three existing sites and offer on-site pharmacy, radiology, and laboratory services, as well as community space that can be converted into a 25-bed shelter. The project will increase medical, dental, and behavioral services, allowing CommuniHealth to serve an additional 3,375 patients annually.

CommuniHealth is a Federally Qualified Health Center established in Bastrop, LA, in 2002, providing care to the uninsured and low-income residents of Morehouse Parish. CommuniHealth provides medical, dental, and behavioral health care services for patients of all ages, as well as pharmacy, substance abuse counseling, transportation, translation, specialty care/services, health education, and comprehensive outreach. Learn more here.

For more information about Capital Link’s capital planning services please contact Jonathan Chapman, Chief Project Officer at This email address is being protected from spambots. You need JavaScript enabled to view it.. To learn more about Capital Fund’s loan products, including New Markets Tax Credits, please contact Brandon Boyle, Director of Loan Programs, at This email address is being protected from spambots. You need JavaScript enabled to view it..